When challenging the customer backfires

23rd April 2017 | Tim Riesterer and Professor Nick Lee

There’s a proper time to provoke the customer – it’s just not when you’re trying to keep them or get them to pay more, research shows.

Provoking the customer, challenging the status quo, leading with an unexpected insight: these kinds of message are the lifeblood of the disruption-minded story you need to tell when you’re the outsider intent on convincing your prospect to change and choose you.

This “why change” story is highly effective at unseating your prospect’s incumbent provider and winning new business. An article in the previous issue of this publication referenced Corporate Visions research which revealed that identifying and introducing an “unconsidered need” – as opposed to responding only to prospects’ stated, known needs – can give you a significant edge in terms of creating the urgency to change.

However, new customer acquisition isn’t the only selling situation practitioners face – far from it. Sometimes, you’re the insider. Sometimes you are the status quo.

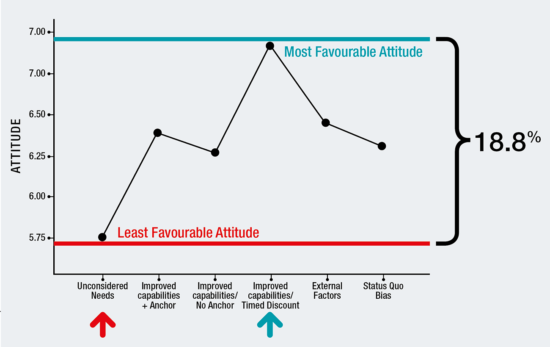

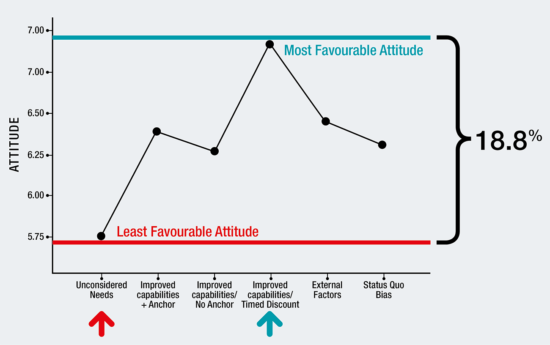

Figure 1

What subsequent research confirmed is that the provocative, insights-driven approach – which fared so well in terms of acquiring new customers – didn’t hold up when it came to securing renewals (what we’ve called the “why stay” conversation). In fact, as was covered in the previous issue, the provocative approach performed far worse in the context of renewals compared with a messaging approach – or framework – that documented business results to date and reinforced the causes of status quo bias.

The research wasn’t an indictment of provocation-based selling approaches per se, which enjoy so much popularity today. Rather, the study was an acknowledgement of the limits of that approach, a warning sign about the dangers of applying those selling techniques to every selling scenario you face.

Building on that research, we wanted to learn more about a related customer dialogue that often goes hand-in-hand with renewals: price increases – or what we’re calling the “why pay” message.

“I need you to pay more”

No matter how you spin it, that message is one of the trickiest, most delicate that salespeople will ever have to communicate to customers, not least because it can veer in the wrong direction, and fast. Yet, for companies with aggressive growth goals who need to get more value from their top accounts, it’s also one of the most essential.

As a precursor to the academic research around communicating price increases, Corporate Visions partnered with this publication to conduct a joint survey to get a read on how customers were handling price increases today. What the survey uncovered, among many things, is that this is a conversation that matters to B2B organizations – though you might not know it given the lack of messaging strategy and structure companies are putting toward it.

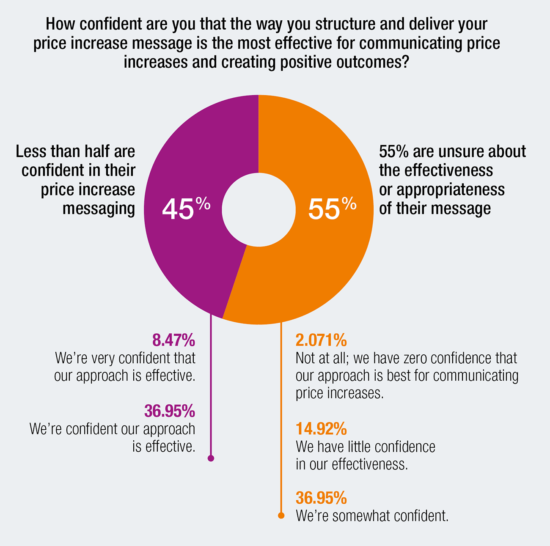

The survey found that nearly two-thirds of B2B professionals believe price increases are “very important” or “mission critical” for maintaining desired profitability and revenue growth (Figure 1).

But get this: Fewer than half of respondents (45 percent) are confident in their approach to communicating price increases. This probably explains why nearly four out of five companies (79%) want a more formal and strategic approach to how they handle this message.

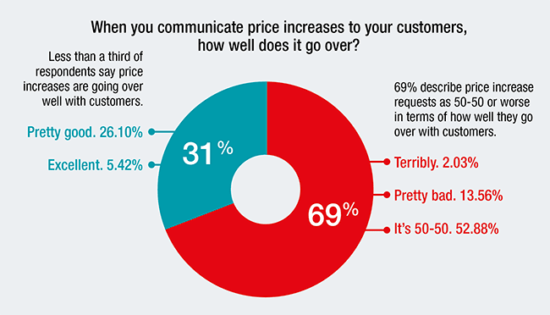

That’s no surprise, given how poorly this message is going over with customers. Almost 70% of companies (69%) in our survey say their success rate is “50-50” or worse in terms of how it is being received by customers. That leaves less than one-third of companies (31%) feeling good about how their price increase messaging is going over (Figure 2).

Figure 2

The consequences of this conversation going poorly aren’t hard to imagine. At worst, it could mean concerning levels of churn. At best, it could mean you’re forced to negotiate a much lower increase than the one you requested – or no increase at all – just to keep your customers. Besides your profitability being on the line, a poorly executed price increase message carries the additional risk of damaging customer loyalty in a way that makes customers susceptible to a competitive alternative.

Strategic importance

The strategic importance of handling price increases well shouldn’t be underestimated, either. Companies often make decisions to get new business in the door that include offering too-good-to-be-true pricing and concessions, hoping to then “land and expand”. Recovering whatever discounts you might have had to offer to win business in the first place might involve cross-selling and up-selling additional services, but it might also call for a strategic effort to begin inching the price back up to respectable rates.

In other words, ongoing investments in servicing accounts and improving solutions – not to mention the rising cost of goods – all end up in the same spot: a post-purchase price increase conversation.

If the survey results reveal anything, it’s that companies appear to know they’re leaving money on the table, getting less than they want or even need from customers. That’s why we collaborated on original research that would provide answers to the following questions: What is the most effective message for communicating a price increase? In other words, what is the best way to pass along a price increase to expand revenue while minimizing risk?

The study: Testing the best message for communicating price Increases

The experiment we developed was structured to assess three areas critical to the effectiveness and reception of a price increase message: attitudes; how likely a customer is to renew; and how likely they are to switch to a different vendor.

Here’s how we set it up. To begin, we recruited 503 participants to take part in an online experiment. At the outset of the study, participants were instructed to imagine that they ran a small business and that two years ago, they needed to do something to improve employee satisfaction and retention rates because employee turnover was high and it was too expensive to keep hiring and training new people.

One of the steps these business owners took included signing up with a vendor who could help promote the company’s health and wellness programme for employees. The hope was that increasing employee participation would also increase employee satisfaction and reduce turnover. At the time, only 20 percent of employees subscribed to the health and wellness programme. The goal was to increase that to 80 percent: the benchmark for businesses with world-class employee retention rates.

The two-year contract signed by the company was nearing its conclusion, and it was time to renew with that vendor or choose an alternative.

Participants were told they’d recently met with some of the other providers they originally considered to see what’s changed in the past two years: they’ve all made improvements and introduced new capabilities; and, while some of the improvements are appealing, nothing really stands out. In addition, pricing appears to be similar to what they are already paying.

Figure 3

However, the current vendor partner is now asking for a price increase for the next two-year agreement.

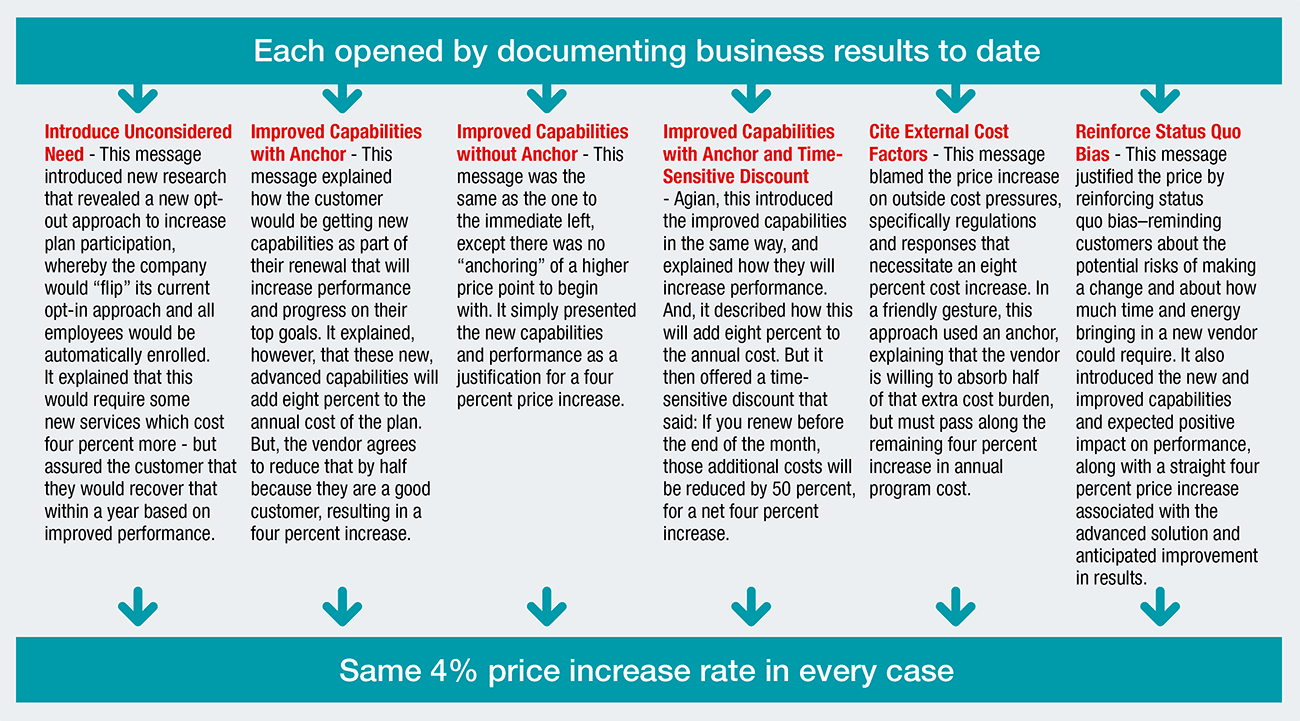

But here’s what participants didn’t know: they were divided randomly into six groups and placed into different message conditions, each of which took a different approach to framing the price increase. Importantly, in each condition, the message opened by documenting the business results to date, and all of them proposed the same 4% rate of increase to the annual cost of the programme. The six approaches (figure 3) are described below:

1. Introduce Unconsidered Need – This message introduced new research that revealed a new opt-out approach to increase plan participation, whereby the company would “flip” its current opt-in approach and all employees would be automatically enrolled. It explained that this would require some new services, which cost 4% more, but assured the customer that they would recover that within a year based on improved performance.

2. Improved capabilities with anchor – This message explained how the customer would be getting new capabilities as part of their renewal to increase performance and progress on their top goals. It explained, however, that these new, advanced capabilities would add 8% to the annual cost of the plan. However, the vendor would agree to reduce that by half because they were a good customer, resulting in a 4% increase.

Figure 4

3. Improved capabilities without anchor – This message was the same as the one above, except there was no “anchoring” of a higher price point to begin with. It simply presented the new capabilities and performance as a justification for a 4% price increase.

4. Improved capabilities with anchor and time-sensitive discount – Again, this introduced the improved capabilities in the same way, and explained how they would increase performance; and, it described how this would add 8% to the annual cost. However, it then offered a time-sensitive discount that said, if you renew before the end of the month, those additional costs would be reduced by 50%, for a net 4% increase.

5. Cite external cost factors – This message blamed the price increase on outside cost pressures. Specifically, regulations and responses that necessitated an 8% cost increase. In a friendly gesture, this approach used an anchor, explaining that the vendor was willing to absorb half of that extra cost burden, but must pass along the remaining 4% percent increase in annual programme cost.

6. Reinforce status quo bias – This message justified the price increase by reinforcing status quo bias – reminding customers about the potential risks of making a change, and about how much time and energy bringing in a new vendor could require. It also introduced the new and improved capabilities and expected positive impact on performance, while proposing a straight 4% price increase associated with the advanced solution and anticipated improvement in results.

After participants received their respective messages, they answered a series of questions designed to assess its impact. The questions were accompanied by scales ranging from one to nine, labeled such that higher scores indicated higher values on the dimension assessed. Responses to the questions were then compared across the groups.

Results

The experiment revealed that the provocation-based message that introduced an unconsidered need was the least effective in terms of framing a price increase – just as it was found to be least effective in the study focused on securing renewals.

Participants in the provocative condition were found to have:

- 18.8% less favorable attitudes toward the message, compared to participants in the new capabilities with timed discount condition, which performed the best in this regard (figure 4).

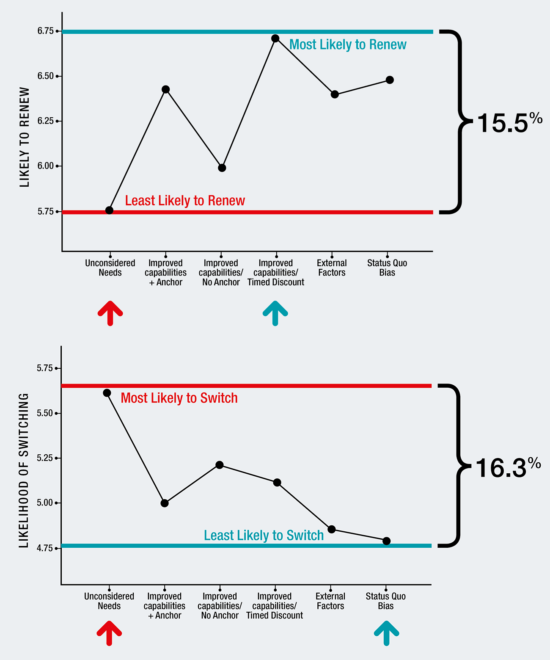

In addition, participants in the provocation-based message were (figures 5 & 6):

- 15.5% less likely to renew with their current vendor, compared with participants in the new capabilities with time discount condition, the highest-performing message in this area.

- 16.3% more likely to switch to another vendor, relative to participants in the status quo bias reinforcement condition, which performed the best in this measure.

Figures 5 (top) and 6 (bottom)

Another thing the research revealed: two of the least-used approaches – as identified by our survey – are the most effective approaches when it comes to communicating price increases.

Only 7% of survey respondents said they anchored a higher price before providing a discount when introducing a price increase. And, only 18% of respondents currently try to justify a price increase by reinforcing the cause of status quo bias. According to the research, both of these approaches are critical factors in terms of executing a price increase message with maximum effectiveness.

The winning “why pay” messaging framework

The results reveal that the winning messaging framework embodies two things:

1. First, it will reinforce the status quo biases while introducing key, new capabilities to solve existing needs – not introduce new needs.

2. Second, it will also anchor high with the new price, before giving a timed, loyalty discount to sign the renewal.

Below is an example of the best-performing messages in the study (it is not meant to be a script, but a framework for your consideration):

Document results to date: “You have made great progress on your goals over these past two years. You’ve seen health and wellness programme participation grow from 20% to 50%. Your employee satisfaction scores are up, and you’ve said some employees have even taken the time to thank you for the changes you’ve made. In addition, your employee retention rates have started to improve, which you said was the ultimate goal of making these changes.”

Reinforce causes of status quo bias: “When you signed up two years ago, you really did your homework and looked at a lot of options before getting your entire team to come to a consensus and choose our company. It was a long process that involved a lot of people, but you ultimately arrived at a big decision to bring this programme on board.

As you look at making a renewal decision, it’s important to realize that you are at a critical point in this journey and that it’s important to maintain momentum to achieve your ultimate participation and retention goals. Any change to the programme at this point could create an unnecessary risk of losing the positive gains you’ve made.

Not to mention that bringing in another vendor would require you to invest time in getting them up to speed and money on implementation costs and other changes that you won’t have to spend if you continue working with us.”

Introduce new capabilities: “Over the past two years we’ve been developing new capabilities to drive more satisfied participants, as well as give you confidence that your programme is keeping pace with anything else available in the market today. As you consider your renewal with us, we wanted to let you know about two new services we think can have a tremendous impact on your goals:

Figure 7

“The first is a new weekly report that shows non-participants in the programme how much benefit that those who are participating are seeing in terms of their fitness and wellness, as well as how much they are saving, and benefiting in terms of healthcare, by being part of your plan versus the alternatives. This kind of communication, on a monthly basis, will provide a gentle nudge to help encourage them to get into the programme for the great benefits.

“Secondly, we’ve also added a new smartphone app with online tools, including automatic result tracking, and integration with popular fitness trackers. In tests, these touches have been shown to help your employees get more benefits from health and wellness programmes, and feel like they’re making progress on their goals. The result has been shown to create higher employee plan satisfaction.”

Anchor price increase high, introduce loyalty discount: “These new services and functionality will add approximately 8% to the annual cost of your plan. However, if you renew before the end of the month, we will reduce the price increase by 50%, making it just a 4% overall increase to get this level of service.

“You’re making great progress. Stick with our programme for another two years, and I know you’ll get to your 80% participation goal and further increase your employee retention rates.”

Conclusion

There’s an appropriate time to challenge your buyers – it’s just not when you’re trying to renew them and convince them to pay more. The results of the study are clear and compelling, and it’s rare to see such strong and consistent results across such a large sample audience and so many different conditions and categories of measurement.

Above all, the findings serve as confirmation that communicating with prospects and customers across the buying lifecycle isn’t a one-size-fits-all thing. While a disruptive message plays well when you’re trying to defeat the status quo bias and displace an incumbent, it shouldn’t be applied universally – no matter how popular the approach might be.