Decide or defer?

22nd September 2017 | Tim Riesterer

Here, we explore why salespeople need help creating urgency with executive decision makers.

Stalled proposals and “no decisions” are arguably the biggest threat to your sales pipelines. There’s a good chance you lose more deals here than you lose to your traditional competitors.

The big challenge often comes down to how you make your case to an executive buyer. It’s estimated that 80 percent or more of B2B decisions require a VP or higher level sign-off. Which means your proposals need to pass business and financial muster with less affected buyers.

Maintaining momentum, increasing deal velocity and improving close rates. Whatever you call it, it’s time someone does some research to understand what will move executives to do your deal, not defer it.

If it seems like executive buyers would rather defer decisions than make them, they can hardly be blamed. There’s a good deal of evidence to suggest that most of the salespeople they encounter don’t have the competence or confidence to go toe-to-toe with them on the business issues that matter most to them or, similarly, to link their business initiatives to the value of your solutions.

Recently a medical equipment company sales rep told me he lost a deal for an MRI (magnetic resonance imaging) machine, not to another MRI competitor, but to a “parking lot”. When I asked what he meant, the rep explained that the hospital executive decided they could improve patient throughput, satisfaction and revenue if they spent $1 million on updating their parking lot instead of a new MRI machine.

This story proved to me that when executives get involved in purchase decisions, there are a lot more considerations that go into that buying process. And, a lot more “competitors” than you may realize for the budget you are seeking, meaning you need to make a better business case for your solution.

In this issue and next issue of the Journal, we plan to cover two pieces of research designed to help you be more effective at communicating and convincing executive buyers to make a decision instead of deferring, and then choosing you instead of an alternative.

First, in this issue we cover a study we conducted called “Executive emotions”. It is designed to determine how much emotions do or don’t impact an executive’s decision. Especially, since they like you to believe they are 100 percent logical, rational decision makers who rely strictly on the numbers in the decision-making process.

Second, in the next issue we will share the results of a new study we are currently running to determine what type of messaging approach will drive the greatest sense of urgency in decision making. The goal is to provide you with a tested, proven “Why now?” story model you can use to get more decisions and fewer deferrals.

Business value gap

Before sharing the first piece of research, it seems important to clearly identify executive expectations of salespeople.

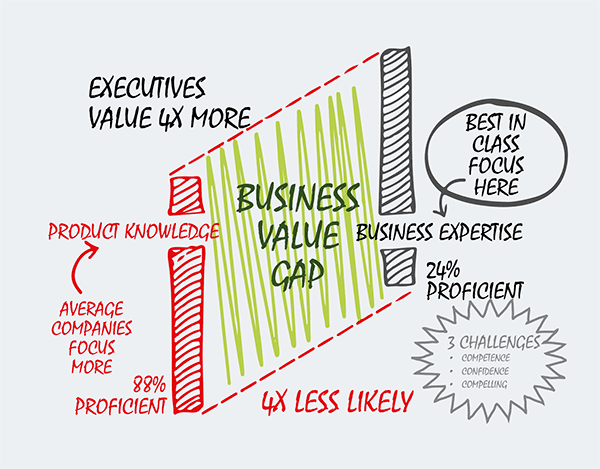

Figure 1: The business value gap that salespeople have to close.

If it seems like executive buyers would rather defer decisions than make them, they can hardly be blamed. There’s a good deal of evidence to suggest that most of the salespeople they encounter don’t have the competence or confidence to go toe-to-toe with them on the business issues that matter most to them or, similarly, to link their business initiatives to the value of your solutions. So, if your deals are getting stuck, or you’re getting delegated down to decision makers with less influence and buying clout, it’s not necessarily because your executive and financial prospects don’t want to change. It’s more likely that you haven’t given them an urgent and compelling reason to do so.

The message that ignites a greater sense of urgency – one that gets executive buyers feeling the need to buy, now – is what we’re calling the “Why now?” story. It’s a conversation you need to master to secure buy-in from your most important prospects and customers. That’s why we’re turning to this moment of truth in our next round of research.

Without a doubt, there’s a big need for a “Why now?” messaging framework, as indicated by findings from a pair of analyst firms – findings that paint a stark picture of why so many proposals stall in the pipeline. Connecticut-based global advisory firm SiriusDecisions found that executives value business expertise four times more than conversations about products and services. Meanwhile, Forrester Research found that executive buyers believe 88 percent of the sales professionals they encounter are knowledgeable about their products and services, and only 24 percent are knowledgeable about the buyer’s business: that is, market trends, key business issues, and the financial metrics that inform buying decisions.1

Taken together, these data points say something fairly alarming about many sales conversations with executives: namely, that today’s sellers are almost four times less likely to be good at the types of business conversations that executive buyers value four times more.

A business value gap?

The disconnect between what executive buyers are demanding (business conversations) and what they’re actually getting (product presentations) creates a business value gap that salespeople have to close (Figure 1).

This gap’s negative impact on sales effectiveness is real. But don’t just take it from me. This was validated in a study by TrainingIndustry.com, which compared the training emphases of both average- and high-performing companies. The study revealed that high-performing companies place:

- three times more emphasis on developing executive selling skills than do average-performing companies; and

- four times more emphasis on developing their team’s financial acumen than do average-performing companies.

These figures are a clarion call for sales professionals today that it’s time to up-skill salespeople on the competencies they need to be impactful in their conversations with executives. At its core, executing against those competencies comes down to “three Cs”:

- salespeople first need to have the competence to understand the relevant external factors executives are dealing with, and then to link your prospects’ core business initiatives to your business value, creating an executive buying vision;

- they also need to have the confidence to engage executive decision makers on their terms, in a business conversation, not a product presentation; and

- finally, they must be able to make a compelling ROI justification that clearly illustrates your impact on their business.

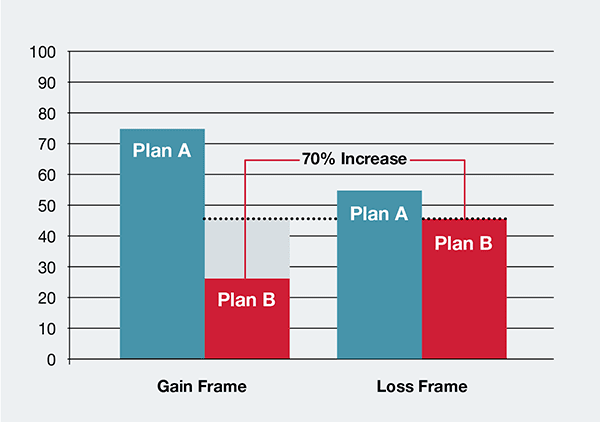

Figure 2: Research demonstrated a 70 percent change in “persuadability”.

Executive emotions: it’s not all about numbers

Clearly, a big part of closing that gap comes down to having the financial acumen to make a business case that justifies investment in your solutions. But recent Corporate Visions research revealed that making the business-focused, analytical case for your solutions is only one dimension of building momentum in your conversations with executives. While important, it alone might not be enough to resonate with executives in a way that breaks through buyer inertia, convincing them to change and to do it now. For that, you need to tell an emotionally compelling story. Yep, you heard me right.

There’s a longstanding myth that executive and financial buyers are impervious to emotions, and that they really only have the time of day for a strictly rational, analytical case for how your solutions can, say, free up budget or make their operations more efficient. This myth has proven to be exceptionally durable, not least because executive buyers tell you it’s true, and you as salespeople believe it. As a result, when you go to craft messages for VP or higher personas or contacts, you do so under the assumption that those prospects are bent on making strictly logical decisions that hinge solely on the balance sheet justification of your value.

Research from Corporate Visions debunked this dated myth about executive buyers. In fact, the study found that in a business decision-making scenario, you can provide executives with the same maths with respect to a business proposition, but get significantly different results depending on how you frame the situation in your message.

In other words, executives (surprise!) are no less swayed by emotions than anybody else. Here’s a synopsis of the research simulation, which involved 113 executive participants from a wide array of industries, including software, oil, finance and aerospace. The participants occupied a range of high-level roles at their respective companies, spanning from vice president up to CEO.

We’ll look to see whether the ideal message requires an emotional, change-driven story or a more analytical, ROI-focused messaging approach.

How we set up the study

At the outset of the study, participants were told that the researchers were trying to learn more about executive decision-making and that participants would be presented with several different hypothetical scenarios. What those participants didn’t know is that they were randomly assigned to one of two conditions – a “gain frame” condition and a “loss frame” condition – which they were placed in before the first scenario and remained in for the duration of the experiment.

In one of the hypothetical scenarios, all participants received the following instructions: “A large car manufacturer has recently been hit with a number of economic difficulties, and it appears as if three plants need to be closed and 6,000 employees laid off. The vice president of production has been exploring alternative ways to avoid this crisis. She has developed two plans.”

Following this overview, participants received information about the two alternatives. The two options were mathematically identical across the gain and loss frame conditions. The key difference? The status quo was framed in one condition as a gain and in the other as a loss.

In the gain frame condition, the options were described in terms of how many plants and jobs would be saved:

- Plan A. This plan will save one of the three plants and 2,000 jobs.

- Plan B. This plan has one-third probability of saving all three plants and all 6,000 jobs, but has a two-thirds probability of saving no plants and no jobs.

In the loss frame condition, the options were described in terms of how many plants and jobs would be lost:

- Plan A: This plan will result in the loss of two of the three plants and 4,000 jobs.

- Plan B: This plan has two-thirds probability of resulting in the loss of all of the three plants and all the 6,000 jobs, but has one-third probability of losing no plants and no jobs.

Keep in mind that these choices, though phrased differently, were mathematically equivalent. Despite this equivalency, there were statistically significant differences in participants’ choices across conditions:

- In the gain frame condition, 74 percent of participants chose Plan A and 26 percent chose Plan B.

- In the loss frame condition, only 55 percent of participants chose Plan A, while 45 percent chose plan B.

The jump with Plan B from 26 percent to 45 percent is significant. Essentially, it means there was more than a 70 percent change in “persuadability” and willingness to choose the risky option by framing it in terms of a loss instead of a gain (see Figure 2). This is important for salespeople, because when you’re the outsider, your prospects will regard your solutions as the “risky” alternative compared with their status quo situation. The results reveal that you can make that change scenario more palatable when you frame your message properly – regardless of the maths.

Next up: The “Why now?” research

In the next issue of the Journal, I’ll join up with Professor Nick Lee from Warwick Business School to discuss the implications of our forthcoming research on the “Why now?” discussion. This research will give us the insight needed to develop a messaging framework that will help salespeople create urgency with executives, helping them to avoid the stalled proposals and “no decisions” that often prove so detrimental to deals and sales pipelines.

In the research simulation, we’ll test a range of approaches to developing and delivering this message, some of which build off the key Prospect Theory–related findings of the executive emotions research covered in this article. Essentially, we’ll look to see whether the ideal message for this situation requires an emotional, change-driven story that we tested in our previous study or a more analytical, ROI-focused messaging approach.

We’ll also test to what extent the principles of Prospect Theory apply to this selling scenario. Stay tuned to see what the research says about how you should – or shouldn’t – handle this critical sales juncture.

These outcomes are consistent with Prospect Theory, and particularly the concepts of loss aversion and risk seeking which comprise it. Prospect Theory, pioneered by social psychologists Amos Tversky and Daniel Kahneman, has some major implications for marketers and salespeople. One of the most important is that humans are significantly more willing to make a change, do something different, or seek a risk to avoid a loss than to acquire a gain.

As our study shows, it appears executive decision makers are no exception. They demonstrate a far greater appetite for the risky bet when their current scenario is framed as a loss.

Why is this important? Because when you’re trying to convince someone to do something new, you are the “risky bet.” As such, it’s imperative that you understand what it takes to get your executive buyer to be more willing or “persuadeable” when it comes to doing something as risky as making the decision to change.

The next step: A “Why now?” messaging framework

This research simulation, which validates the importance of applying decision-making science to your discussions with executives, presents a potentially powerful preview of what a “Why now?” messaging framework might resemble (and what sorts of techniques it will depend on). But it’s not enough to just infer what kinds of message might work best. That offers little guarantee that you’ll know the right story to tell to avoid stalled proposals, secure executive buy-in, and create the optimal level of urgency to sway change-averse buyers to do something different now. This is something that has to be put to the test. That’s what we intend to do.

While it was a breakthrough to discover the importance of tapping into decision-making science principles and emotional storytelling techniques to be more impactful with executive buyers, there are still some gaps we’d like to fill in. Our forthcoming research will attempt to do just that.

Our simulation will test a range of messaging frameworks against one another to determine which CXO-relevant story is most persuasive in terms of building momentum, progressing deals through the pipeline, and getting buyers to act now. The ultimate goal is to leave the research with a fully developed messaging framework designed to help you handle the challenges specific to this critical selling situation – so you can get more decisions and fewer deferrals.

And, we will be publishing the results right here in the next issue of the Journal. Stay tuned.

1 Dewing H, Mines C, Yamnitksy M (2011), Information Workers Are A New Buying Center For Enterprise Technology, Forrester Research.