Shareholder value measurement essential for effective KAM

7th April 2016 | Professor Malcolm McDonald

How the investment community works and why SV is good not only for marketing, but also for KAM.

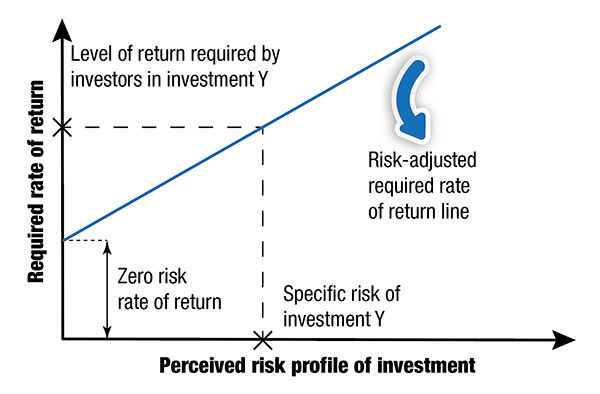

Figure 1: Risk-adjusted required rate of return

There are two schools of thought about the topic of shareholder value (SV). One school, led by Professor Hugh Davidson, argues that it leads to short-termism. The other school, to which I belong, argues that short-termism has been endemic in Western economies for decades and that this has little to do with SV.

During a 20-year period, up to 2000, every high-performing company in the FTSE top ten in terms of ROI subsequently either went bankrupt or was acquired. The reason isn’t hard to fathom. As Collis said in a Harvard Business Review article in 2008, most directors don’t even know what the components of a strategy are, whilst Christensen said, also in HBR, of 30,000 new product failures in 2006, most were caused by poor marketing.

But to single out SV as a major cause of this is disingenuous in the extreme, for it is managers who are short term in their behaviour, not the financial investment community. It also reveals a common misunderstanding about what SV really is and how stock markets around the world work.

PLEASE NOTE: Subscriber-only content – To read the full article, please login or purchase a subscription. Subscription Options Login