B2B BUYERS PREPARED TO SPEND $1M+ ONLINE

DESPITE CONVENTIONAL WISDOM THAT BIG-TICKET SALES REQUIRE IN-PERSON CONTACT, 20% OF B2B BUYERS ARE WILLING TO SPEND MORE THAN $500,000 IN A FULLY REMOTE/DIGITAL SALES MODEL.

11% WOULD SPEND MORE THAN $1 MILLION.

IN CHINA, THE INCLINATION TO SPEND MORE THAN $500,000 ON A REMOTE SALE JUMPS TO 40%.

ENTHUSIASM FOR COMPLETING BIG-TICKET DIGITAL PURCHASES HAS THE PROPENSITY TO CONTINUE, AND COMPANIES ARE NOT EXPECTING IN-PERSON SELLING TO CONTINUE TO BE THE NORM.

WHILE MOST ORGANIZATIONS SAY THEY WILL RETURN TO IN-PERSON SELLING IN 2021 – WITH 90% OF B2B SELLERS EXPECTING TO HOLD IN-PERSON MEETINGS BY THE FOURTH QUARTER OF 2021 – ONLY 15% OF ORGANIZATIONS EXPECT IN-PERSON SALES TO REPRESENT MORE THAN 75% OF THEIR SALES INTERACTIONS.

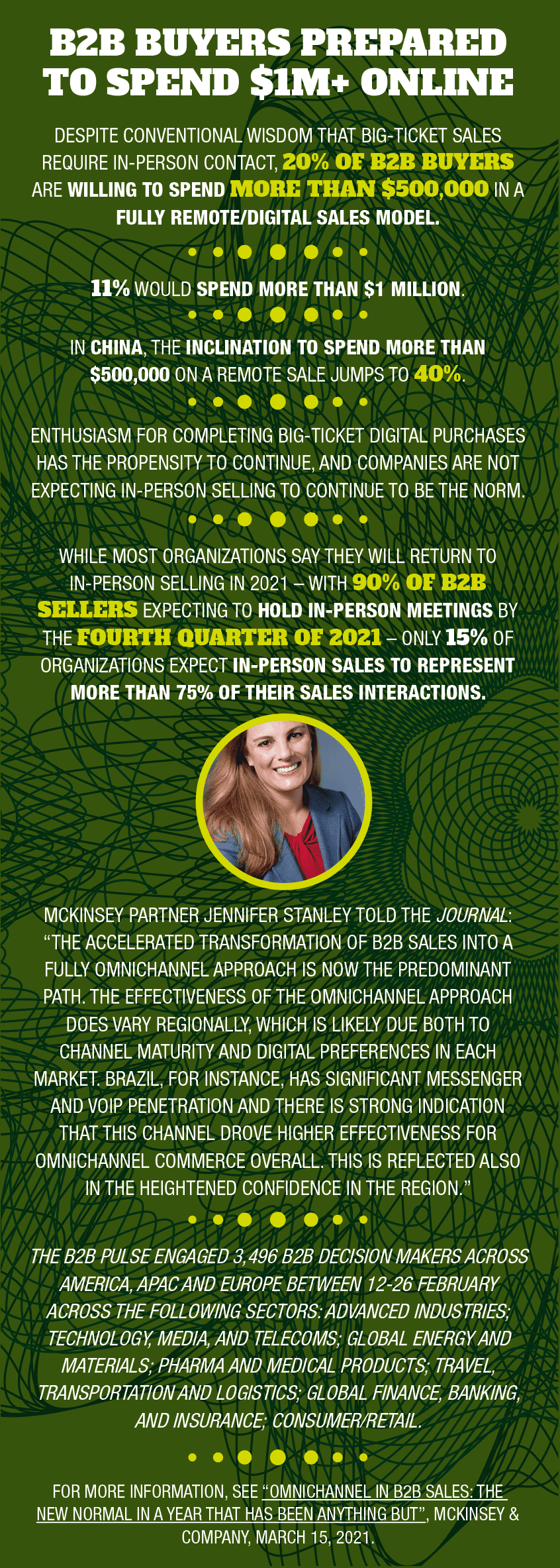

MCKINSEY PARTNER JENNIFER STANLEY TOLD THE JOURNAL: “THE ACCELERATED TRANSFORMATION OF B2B SALES INTO A FULLY OMNICHANNEL APPROACH IS NOW THE PREDOMINANT PATH. THE EFFECTIVENESS OF THE OMNICHANNEL APPROACH DOES VARY REGIONALLY, WHICH IS LIKELY DUE BOTH TO CHANNEL MATURITY AND DIGITAL PREFERENCES IN EACH MARKET. BRAZIL, FOR INSTANCE, HAS SIGNIFICANT MESSENGER AND VOIP PENETRATION AND THERE IS STRONG INDICATION THAT THIS CHANNEL DROVE HIGHER EFFECTIVENESS FOR OMNICHANNEL COMMERCE OVERALL. THIS IS REFLECTED ALSO IN THE HEIGHTENED CONFIDENCE IN THE REGION.”

THE B2B PULSE ENGAGED 3,496 B2B DECISION MAKERS ACROSS AMERICA, APAC AND EUROPE BETWEEN 12-26 FEBRUARY ACROSS THE FOLLOWING SECTORS: ADVANCED INDUSTRIES; TECHNOLOGY, MEDIA, AND TELECOMS; GLOBAL ENERGY AND MATERIALS; PHARMA AND MEDICAL PRODUCTS; TRAVEL, TRANSPORTATION AND LOGISTICS; GLOBAL FINANCE, BANKING, AND INSURANCE; CONSUMER/RETAIL.

FOR MORE INFORMATION, SEE “OMNICHANNEL IN B2B SALES: THE NEW NORMAL IN A YEAR THAT HAS BEEN ANYTHING BUT”, MCKINSEY & COMPANY, MARCH 15, 2021.